Table of Contents

Introduction

Standing up a card program involves a lot of players. As you might've read in our Intro to Card article, one of the key components is a card issuer, an agency who provides the actual cards (physical, digital, or both) and offers a connection to card networks. If you're connected to an issuer through LoanPro, then you can extend cards to borrowers, and their transactions can make it all the way from a merchant, through the chain of card infrastructure, and into your LoanPro account, where you have both a ledger and robust toolkits for servicing, collections, payments, and more.

When it comes to which issuer to use, the choice is entirely yours. Our Bring-Your-Own-Issuer (BYOI) infrastructure means that LoanPro is completely agnostic towards issuers, leaving you free to work with the issuer of your choice.

Highlights

Let's breakdown how issuers work within LoanPro's card system.

Authorization Path

It's important to understand the role issuers play within the context of the broader card system. They're a crucial link in the chain of financial systems that connect customers to the financing programs you've launched.

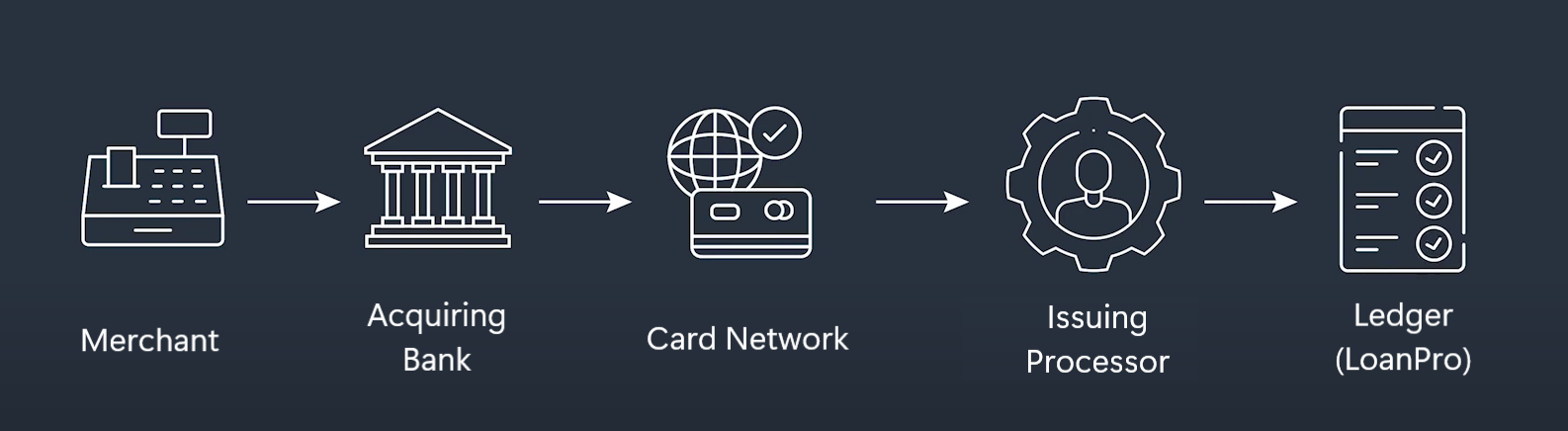

When a borrower makes a swipe, it typically follows this authorization path:

The transaction information goes from the merchant (either a brick-and-mortar store or a digital vendor) to the acquiring bank that the merchant works with. From there, it goes through the card networks to the issuing processor who issued the card that initiated the whole transaction.

The issuing processor then connects to the ledger managing the account—in this case, LoanPro. If the card allows the transaction (meaning it has enough available credit and there are no other restrictions), then that authorization flows back through the path until it reaches the merchant, who can now finish their transaction with the customer.

And at the same time that the issuing processor gets approval information from LoanPro, they also send in transaction information that helps route the swipe to the appropriate bucket. Information about the amount of the purchase, the time and place when it was made, the merchant category code (MCC) for the store, and other details will all work through the transaction routing in LMS to sort the swipe into the right bucket based on your business logic and policies.

Issuers, Programs, and Cards

As we explain in Intro to Card, there's a basic hierarchy to the entities saved in Secure Payments, with issuers sitting near the top. Each level of this hierarchy is a one-to-many relationship; a single issuer can have countless programs, but a program can't be shared between two processors.

- Secure Payments Account. Each lender using LoanPro gets an account with Secure Payments, our PCI-compliant system for storing card and payment profile data.

- Issuing Processors. Within your Secure Payments account, you can integrate with multiple issuers. (See the BYOI tab for more on the subject.)

- Card Programs. A card program is the template used to create cards. When you create a card, you won't manually select the issuer, but instead use the issuer saved to the program. The card program also determines the network and what kind of swipes are blocked.

- Cards. You can use card programs to create cards for borrowers. It inherits all of its settings from the card program, except for the borrower-specific info like their name and billing address. Most of those settings can be edited on individual cards, but the card is locked in to the issuer and network that the program uses. Cards can be physical pieces of plastic, electronic cards (like the card you might have saved in your smartphone), or both, depending on what the issuer supports.

BYOI

LoanPro's Bring-Your-Own-Issuer (BYOI) infrastructure allows us to work with the card issuer of your choice, whomever that may be. You have complete flexibility in the network and issuer you work with.

Once you've selected an issuer (or several issuers), you can use the Secure Payments API to connect them to our system. Secure Payments is already connected to LMS, so the issuer doesn't actually need to touch LMS directly.

Where Do Issuers Fit?

Issuers are vital to the connection between LoanPro and the card networks that your customers use every time they make a swipe. If you don't have a connection with an issuer, you'll be unable to extend credit through a card that's linked to the accounts saved in LoanPro. But once that connection is established, you'll be able to issue cards from within LoanPro, and your customers' activity will flow seamlessly through the authorization path, ending with a complete record of the transaction saved in LMS.

This Feature is Not

Let's clear up some possible misconceptions about how issuers works with our system.

- LoanPro itself is not an issuer. We can provide our modern lending core as an account ledger and calculator, paired with best-in-class suites for servicing, collections, data reporting, payments, and more—but we're not an issuing processor. To issue cards, you'll have to partner with a dedicated issuer.

- LoanPro can't build a custom connection for you. While our BYOI infrastructure enables you to connect any issuer to our system, it does involve some resources on your part. If you don't have the tech personnel and time, then BYOI might not be feasible for you.

What’s Next?

In the near future, we'll have more documentation about cards, issuers, and everything else we've discussed in this article. In the meantime, though, you'll probably be interested in both Intro to Card and Intro to Line of Credit Accounts, which explores the calculations, servicing, and collections tools we have available in our lending core, LMS.