Table of Contents

Introduction

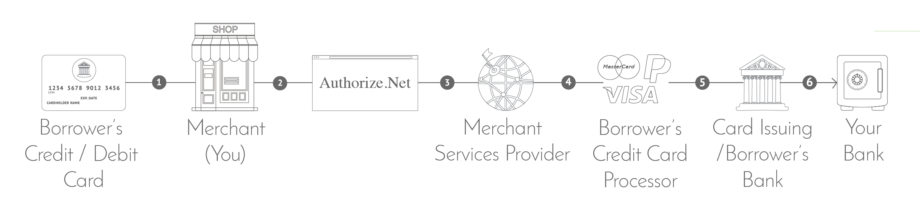

In order to process bank card payments, a merchant (any company that accepts cards) will need a merchant services provider. But what is a merchant services provider, and how does it fit into a bank card transaction? The basic transaction works like this: Your customer has a card that they got from their bank. You enter the card data into LoanPro and click to process a payment. LoanPro sends the payment information to Authorize.net. Authorize.net sends the transaction to your merchant services provider who sends it to the bank card processor (Visa, MasterCard, American Express, etc.). The processor signals the transfer of funds from the customer’s account to your account, completing the transaction.

Use Cases

Select Bankcard

Use Case: Payments/Merchant Services/Select Bankcard

The Problem:

Suppose you decide to start taking payments through bank cards. In order to do this, you need to find a merchant services provider that will give access to the card networks. Unfortunately, your search for the right one is a frustrating process. The providers you found negotiated very high rates and the ones with some promise didn't end up approving your application. It turns out that some merchant service providers are hesitant to approve certain lending companies. As a result, transitioning to bank card payments is taking a lot longer than you had anticipated.

LoanPro's Solution:

LoanPro alleviates the headache of searching for a merchant services provider by partnering with Select Bankcard. We've done the work of sifting through different providers and found one that will provide good rates that'll make lenders pay less per transaction, approve lenders easily and avoid the cost of a flat-fee model. Our partnership with Select Bankcard creates value by taking the work off your hands and allowing your time and effort to be put towards other important responsibilities.

So, what should you look for in a merchant services company? For many lenders, the first priority is pricing, and LoanPro's relationship with Select Bankcard provides the best available price for our customers. However, there is also something to be said for a company that will be there when you need to ask questions, or a company that will help you sign up for additional services like Authorize.net.

Additionally, your merchant services provider will charge you fees. The best arrangement is to get a merchant services provider who will uses an interchange+ model, which Select Bankcard does. The other option is a flat-fee model, which almost always results in a higher cost. Here are the fees that may be charged by a merchant services provider:

Interchange+

Interchange Reimbursement Fees and Assessments: These are the fees the card-issuing banks and the card associations charge for each transaction, and they represent what the largest expense merchants (should) pay per sale and per month. Interchange fees typically consist of a percentage of each transaction accompanied by a flat per transaction fee (2.10% + .10). Assessments are typically based on a percentage of the total transaction volume for the month. Examples of these non-negotiable interchange and assessment merchant account fees include: Merit 1/ecommerce/CNP fees, NABU/APF/data usage fees, Dues and assessments. Each card association (e.g. Visa, MasterCard, Discover, American Express) publishes their interchange and assessment fees online. Remember, these are the wholesale rates. Now, let’s say you’re on an interchange-plus pricing structure. Your processor will quote you something like (.25% + .10). THAT is their markup. That is the amount that they will add to the wholesale rates. But, if you’re on a tiered pricing plan, you’ll get a quote with the Qualified, Mid-Qualified, and Non-Qualified rates. Those quotes have the margin baked right into the quote, thus making it more difficult to tell what the processor's margin is.

Flat Fees

Merchant services providers using a flat fee pricing model will often break their costs down into smaller fees associated with a particular aspect of the service they provide. Here's a quick rundown of the most common fees.

| Fee | Explanation |

| Terminal Fees | These are charged to merchants who have physical stores where they directly swipe a customer’s card. If you run a business online, you will not have to worry about this. Some providers try to lock merchants into terminal leases, but as we’ve mentioned before, don’t lease a terminal. Most of our favorite providers will encourage you to buy your machine outright for a low one-time fee. This option can, literally, save you thousands of dollars in the long-run. For an example of this, check out Helcim. |

| Payment Gateway Fees | These are similar to terminal fees, but they are applied to e-commerce businesses instead. Some processors have in-house payment gateways that are free of charge (CDGcommerce). |

| PCI Fees | These are fees paid to the Payment Card Industry, either for noncompliance or compliance. In the case of noncompliance, you have to pay because your business is not upholding PCI standards, which could cost you even more money in the long run. In the case of compliance, you have to pay the merchant account provider to make sure you remain in line with the regulations at all times. Unfortunately, some providers charge for this service without actually providing it, so you need to make sure you are being cared for at all times. |

| Annual Fees | These are fees charged every year to cover the basic use of a provider’s services. In our eyes, this is a bogus fee. Most of the better merchant account providers will not charge it. |

| Early Termination Fees | This is pretty self-explanatory. It is a fee that is charged if you cancel your contract early—another fee you definitely want to avoid. |

| Monthly Fees | These are fees that are charged each month, usually for the purpose of covering call center costs. Ironically, most of the phone calls that come in are the result of mistakes made by the merchant account providers, making them the cause of their own fees. If you’re looking for the lowest monthly fee possible (a good idea if you have a low volume) take a look at Payline Data. They have a plan for just $5 per month. |

| Monthly Minimum Fees | These are fees charged to merchants who do not reach a certain transaction total for the month or year. The minimums will vary by provider, but most of them are around $50,000 a year. This is another fee that is not charged by some of the better providers like Dharma Merchant Services. |

| Statement Fees | These are fees charged to cover printing and mailing costs for bank card statements. Some merchants bypass these costs by using electronic bill statements, but others pay as much as $15 a month for miscellaneous processing costs. |

| IRS Report Fees | These are fees that merchant account providers charge in exchange for reporting transaction information to the IRS (1099-K). Most of these charges range from $2 to $5, depending on the provider. |

| Online Reporting | These are alternatives to statement fees, charged to merchants who choose to view their statements online. Most providers will not charge this kind of fee, and those that do often lump it together with others. |

| Network Fees | The card networks charge certain non-negotiable fees that are passed through to the merchant, such as the FANF. |

Incidental Fees

These other fees might show up with some merchant services providers using a flat fee model.

| Fee | Explanation |

| Address Validator Service (AVS) | If you have an e-commerce or telephone order business, beware of the AVS fee. It will be charged on every single transaction. For retail businesses that occasionally key-in card information, you don’t need to worry about it as much. |

| Voice Authorization Fee (VAF) | Rarely, you may be required to call a toll-free number to verify certain information before a transaction is authorized. This doesn’t occur often, so don’t worry about this fee too much. |

| Retrieval Request Fee | Every time a customer initiates a dispute on a charge from your business, it sets into motion the chargeback protocol. This retrieval request is the first step. The fee covers any expense related to the retrieval request. |

| Chargeback Fee | After the retrieval request, the actual chargeback may occur depending on the circumstances. If it does, expect another fee on top of losing the money from the sale. |

| Batch Fee | Every time you submit a batch of transactions, a batch fee (or batch header) is charged. It only happens once or twice a day, so don’t worry too much about an extra dime or two. |

| NSF Fee | If you don’t have enough funds in your bank account to cover your merchant account expenses, you will be assessed a NSF (non-sufficient funds) fee. |