Table of Contents

Audience: Upper Management, Administrator

Introduction

There are several different types of defaults that can be set in LMS. In this article we'll be explaining the basics of what defaults are and why they're useful. We'll also go over what types of defaults are available in the system, though we won't go into too much detail about the individual types at this juncture.

What are Defaults?

Defaults are preselected options in the system. If defaults have been set, a user who performs a specific action—such as creating a loan or making a transaction—won't need to manually enter information because the system will automatically do it for them. This generally makes the process go faster and leaves less room for human error. However, users can still change the default information if needed.

Where do Defaults Fit?

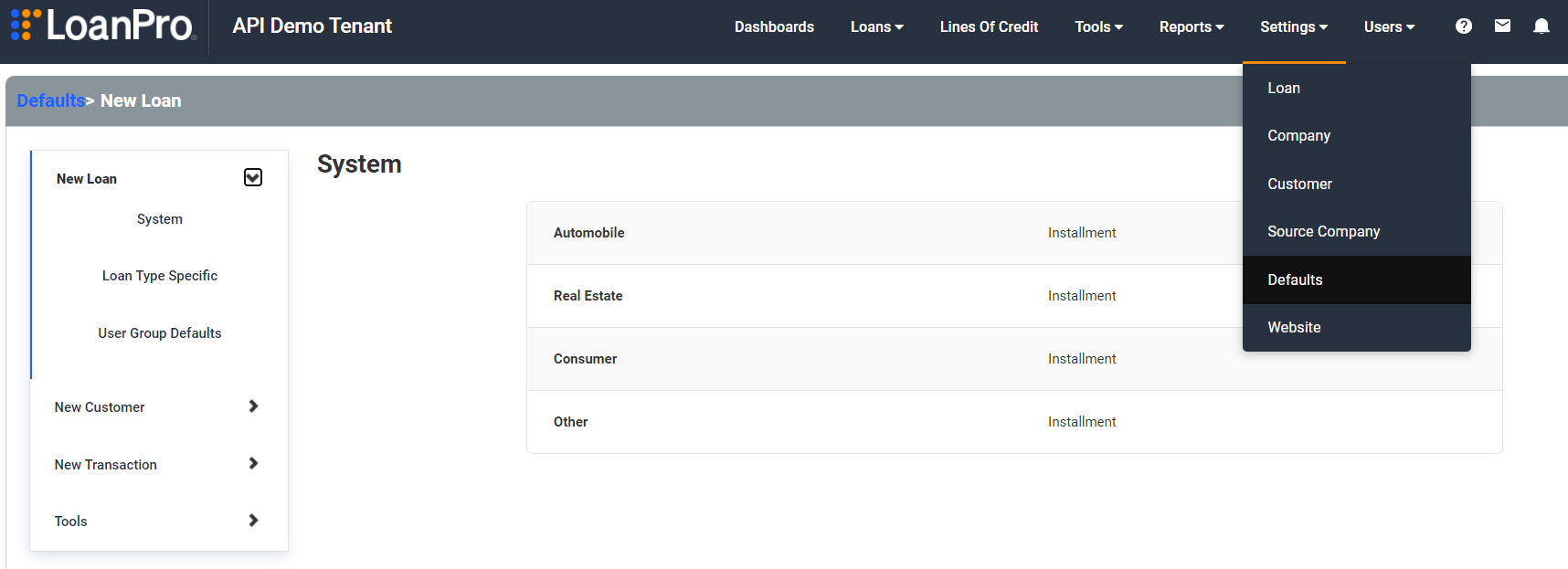

To view or edit your defaults, navigate to Settings > Defaults.

There are four different main categories of defaults, each of them including a number of different default options.

- New Loan

- New Customer

- New Transaction

- Tools

New Loan

The defaults available for new loans are system, loan type specific, and user group defaults. As the category name suggests, all of these defaults will effect any loans created after the defaults are set.

| Default | Description |

| System | Allows you to specify the loan type for each of the loan classes in LoanPro (auto, real estate, consumer, other). |

| Loan Type Specific Defaults | Builds on the system default and lets you designate information and settings for a new loan depending on the loan class and type. |

| User Groups | Allows you to assign specific loan setup configurations for users. For example, if you have two different teams that focus on different types of loans, the defaults for that loan type can be set for relevant users. |

New Customer

Defaults for the new customer category include customer defaults and enrollment by loan status.

| Default | Description |

| Customer Defaults | Allows you to choose basic defaults for customers created in your company account. |

| Enrollment by Loan Status | Lets you determine which communication methods will be active for a customer depending on the status of their loan. |

New Transaction

New charge and new payment are the defaults in the new transaction category.

| Default | Description |

| New Charge | Allows you to set the charge type, whether the charge should be interest bearing, and whether the charge should be included in the days and amount past due calculation for new charges on a loan. |

| New Payment | Lets you select the default options for things like payment type, extra towards options, service fees, payment method, authorization type, early payment, and reset past due settings. Different defaults can be set depending on loan class and type. |

Tools

The only default option in the tools category is the AutoPay default, which allows you to determine which values will be preset when a new AutoPay is created on an account.

This Feature is Not

Let's clear up some possible misconceptions about defaults in LoanPro.

- Changing defaults won't affect existing loans, customers, transactions, or AutoPays. Defaults are what gets set when something is initially created, such as a loan or a customer. Changing the defaults won't override the existing values, so it will only effect items created in the future, not ones that have already been created.

- Defaults don't restrict users from changing those values. Defaults are meant to save time, not to control users' abilities in the software. Instead, you should read our article Intro to User Access, which goes over the different tools you can use to shape how your agent users interact with LMS. (If you want users to be able to create loans without changing any of their settings, we recommend you use Preconfigured Loans create new accounts and use roles to restrict agents from making edits.)

What's Next?

Now that you know all about the basics of defaults, you might be interested to dig into the specific types of defaults that can be set. To learn more, check out the following articles: