Table of Contents

Introduction

After completing the customer acquisition and underwriting process, lenders provide their potential borrowers what is referred to as an "offer of credit". This is a proposed loan or line of credit that the lender offers to a borrower based on their financial history and needs. Some lenders specialize in several specific offers of credit and market them to borrowers that fit within determined profiles. Others may create personalized offers to each of their lenders.

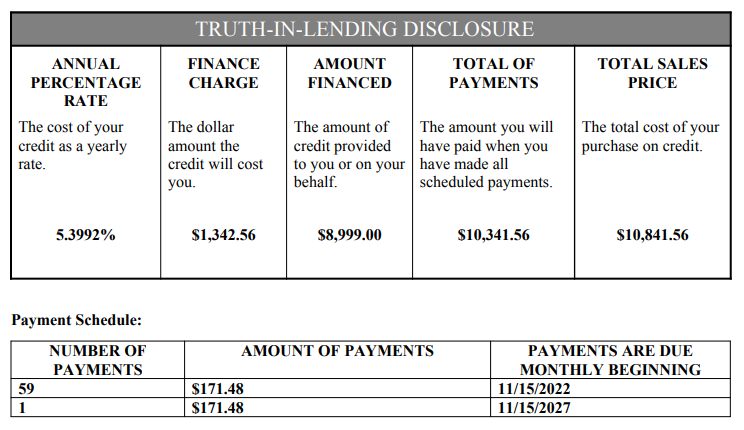

Each lending business is different, but each lender is required to send a potential borrower a Truth-in-Lending (TIL) Disclosure when an offer of credit is made. This document discloses to their borrower the terms and cost of the loan or line of credit that the lender is offering. This requirement was established by the Truth-in-Lending Act (TILA), and it applies to both closed-end loans and open-end loans.

In this article, we'll break down the pieces to an offer of credit and explain what is required.

What is an Offer of Credit?

Like we mentioned above, an offer of credit is a proposed loan or line of credit that the lender offers to a borrower based on their financial history and needs. Once a borrower has provided their desired credit amount and has been vetted by the lender, the lender will send the terms of a loan or line of credit that they feel are fair. If the borrower agrees to the terms of the offer, they'll enter into a loan agreement with the borrower.

Offers of credit differ between lenders, and some lenders offer specific loan products to their borrowers. For example, lenders who specialize in quick, online-only loans will categorize their potential borrowers into a few groups—often based on a set of values that determine borrower riskiness. Each category will have a pre-determined offer of credit, and the borrower will receive the offer they qualify for. Other lenders create personalized offers each time a borrower is considered. Auto lenders usually operate this way, since each lending situation for them will be different: Each of their borrowers has a different financial profile, and each loan amount differs since no two vehicles are the same.

What is Required in an Offer of Credit?

When a lender sends an offer of credit to a borrower, they are required by federal law to include a Truth-in-Lending (TIL) Disclosure. This document discloses the proposed terms and cost of the loan or line of credit to the borrower. This is a consumer protection regulation established by the Truth-in-Lending Act (TILA for short, and sometimes referred to as Regulation Z), and it provides the borrower a fair chance to review the offer and decline it if it isn't satisfactory. All lenders offering closed-end loans (like car and home loans) and open-end loans (think credit cards) are required to send TIL Disclosures.

A TIL Disclosure is required to include the following information:

| Required Information | Description |

| Annual Percentage Rate (APR) | This is calculated percentage that displays how much interest will accrue in a year. |

| Finance Charges | This is the dollar amount the credit will cost. This includes application fees, late fees, and prepayment penalties, and each must be disclosed. |

| Total Amount Financed | This is the amount of the loan that's being financed. |

| Total Amount in Payments | This is the total amount that the borrower will pay once they've made all of their payments. |

| Total Sales Price | This calculation isn't required, but some lenders will provide it when a down payment is included. |

| Payment Schedule | This outlines the payments the borrower will make. This should include the payment frequency, amount, and beginning and end dates. |

LoanPro's Solutions

Since TIL Disclosures are a federal requirement for nearly every lending situation, lenders will have to determine how to create and distribute them to their prospective borrowers—no way around it. However, LoanPro users can benefit from using Custom Forms to create these disclosures and Trigger-Based Notifications to distribute them automatically through our integrated Customer Communication tools. (In fact, the TIL Disclosure in the image above was created with LoanPro's Custom Forms tool.) Combining all of these tools together will make the process of offering credit to your customers the easiest part of your lending business.

What's Next?

If you're interested in learning how to automate your credit offering process, we recommend reading up on the topics linked above. Each of those articles start at a "basics" level and link to articles that increase in complexity. Since offers of credit are regulated by lending laws, you may be interested in our Compliance category. Here, will provide information for lenders looking to remain on the right side of the law.