Table of Contents

Audience: Developers, Data

Introduction

At first glance, the import tool may seem similar to the LoanPro API: both tools allow you to circumvent the normal user interface and interact with the system more efficiently. Still, these tools have different uses and will be best-suited to different situations.

Here's a breakdown of the key differences:

| Import Tool | API |

| Manual process that can be used to quickly add large amounts of data to LoanPro. | A tool that allows developers to create software capable of communicating with LoanPro and automatically adding or editing data within LoanPro software. |

| Mainly used for a company's initial import of data, not for daily processes and loan actions. | May be constantly in use and is generally used in daily processes and loan actions. |

| Requires no programming experience or training. | Proficient use generally requires the work of a software developer. |

Import Tool

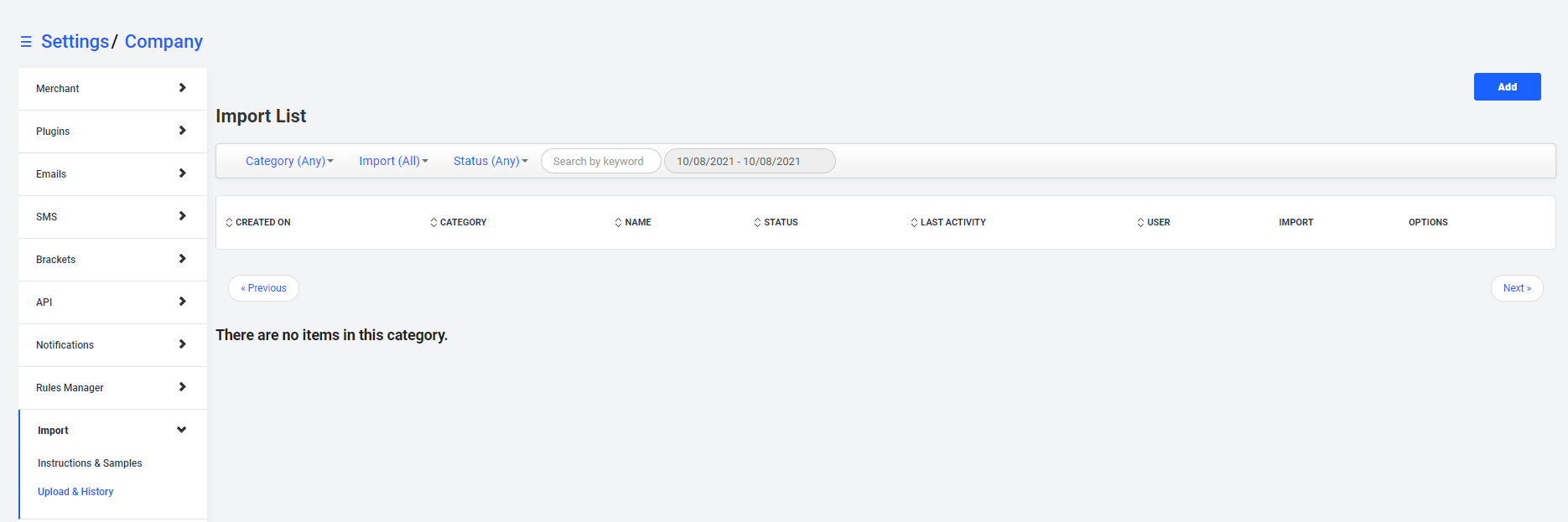

You navigate to the import tool by going to Settings > Company > Import.

The import tool was created to allow users to add large amounts of data to the LoanPro software in a short amount of time. The import tool has the ability to add, update, and remove information from the software.

To use an import file, a user must create and then import it into the system, meaning that an import is a manual process. The import tool does not communicate with any third-party software or websites, and any update that is made to information in your company using an import will only occur one time. An import will not continue to affect any information in the software once it has been run.

The import system is intended for moving data into LoanPro in bulk. When a company first starts using LoanPro, all of its existing loan information is generally entered in LoanPro via the import tool. The import tool is designed for speed; for this reason, it does not run all processes associated with usual actions in LoanPro. Below are links to instructional examples of how to run a few common imports within LoanPro:

- Customer Information Import

- Loan/Lease Import

- Import Example - Payments

- Import Example - Roll Schedule

For more information regarding imports, take a look at our imports documentation.

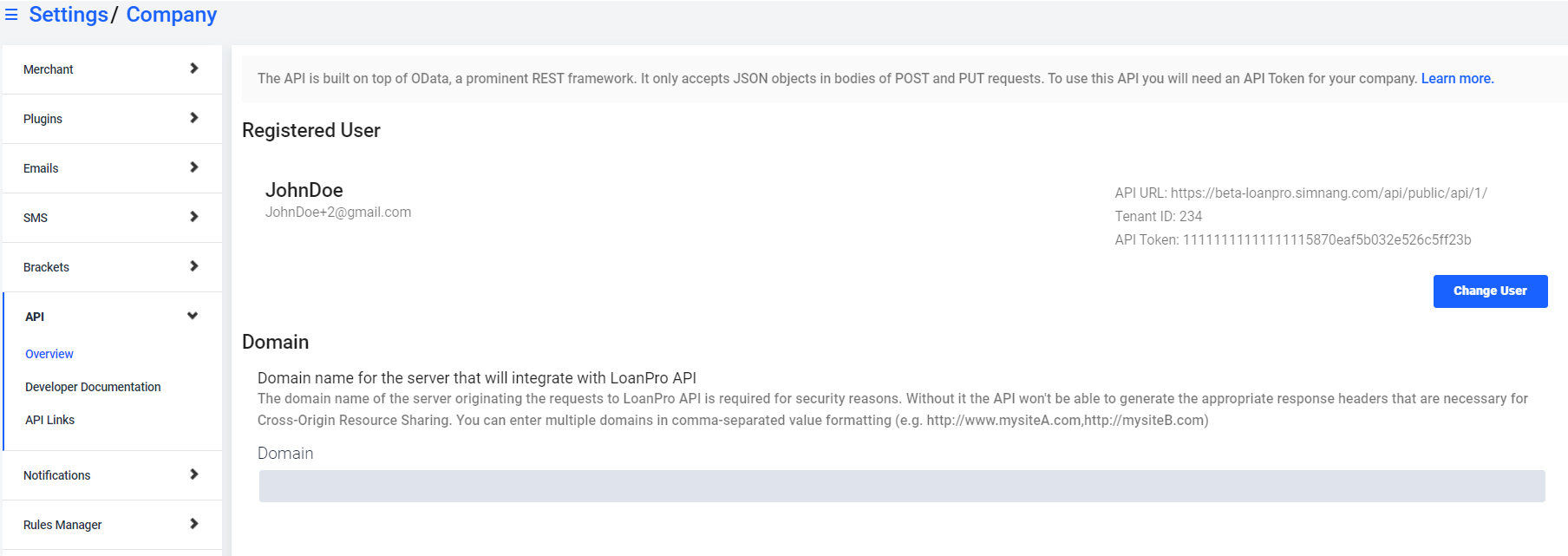

API

The LoanPro API (Application Program Interface) integrates other software with the LoanPro servicing system. The API allows another software application to send requests to create, read, update, or delete information stored by the LoanPro loan servicing API. This means that software can be built by developers to perform actions that will automatically affect information within LoanPro and vice versa. For this reason, the API can be used to access almost any processes associated with usual actions in LoanPro.

The API is generally used by companies who would like to combine their own personalized software with the servicing power of LoanPro. Companies can also use the API to build third-party tools that work in conjunction with LoanPro to fulfill their specific processes. An example of this would be a customized application website. A company may choose to build their own application tool and then have the application tool connected to LoanPro through the API. This would mean that once a potential borrower has created an application on the company website, their information could be automatically entered in LoanPro as well.

What's Next?

If you found this article helpful, you might also be interested in APIs 101 and Connecting to the LoanPro API.