Table of Contents

Vetting the trustworthiness of your potential borrower is a crucial part of the underwriting process. That’s why LoanPro is integrated with two partners for pulling FICO scores and other credit history information: Bloom Credit and CRS.

This article will go over setting up and performing a credit check from within LoanPro.

Sign up and configuration

Before pulling any credit history, you’ll need the process set up in your Center LMS tenant. Speak with your regular LoanPro contacts, and they can get you started.

First, you’ll need to sign up with one of our credit pulling partners, Bloom Credit or CRS Credit, and select which of their products you intend to use. (Your LoanPro contact can get you in touch.)

Bloom Credit

With Bloom, you are able to utilize numerous credit products including:

- Equifax Silver Soft FICO Internet

- Equifax Gold Soft FICO Internet

- Silver Soft Vantage Internet

- Equifax Gold Soft Vantage Internet

- Equifax Silver AR Vantage

- Equifax Gold AR Vantage

- Equifax Bronze Hard (Will NOT update score; report only)

- Equifax Bronze Soft Internet (Will NOT update score; report only)

Before pulling credit, you must contract with Bloom directly. This is done by reaching out to your LoanPro contact. Once you’re signed up, they’ll give you the following information, which you should pass on to LoanPro:

- Client_ID

- Client_Secret

- Bloom Portfolio ID

- Contracted Credit Product SKU

CRS Credit

In addition to Bloom, CRS Credit also provides you with the capability to access numerous credit products.

Equifax:

- Equifax Prequal Vantage 4

- Equifax Prequal FICO 8

- Equifax Prequal FICO 9

- Equifax Hard Vantage 4

- Equifax Hard FICO 8

- Equifax Hard FICO 9

Experian:

- Experian Prequalification FICO 8

- Experian Prequalification FICO 9

- Experian Prequalification Vantage 4

- Experian Hard FICO 8

- Experian Hard FICO 9

- Experian Hard Vantage 4

TransUnion:

- TransUnion Prequalification FICO 8

- TransUnion Prequalification FICO 9

- TransUnion Prequalification Vantage 4

- TransUnion Hard FICO 8

- TransUnion Hard FICO 9

- TransUnion Hard Vantage 4

You’ll need to contract with CRS directly before pulling credit information; your normal LoanPro contact can get you in touch. Once you’ve contracted with CRS, they’ll give you the following information, which you should pass on to LoanPro:

- Client_ID

- Client_Secret

- Contracted Credit Product SKU

Once you’ve signed up and shared your credentials with your LoanPro contact, they can use them to set up the process in Center LMS. The process connects several LoanPro tools together to create a seamless credit pulling experience, explained below.

Pulling a customer's credit information

Depending on your own configuration preferences, you could trigger a credit pull through any number of tools: an Agent Walkthrough, a Quick Action, or an automation. Your own process, then, might look different, but here’s how our default process works through an Agent Walkthrough:

- To pull credit on an individual customer, navigate to an account they’re linked to and click Servicing > Agent Walkthroughs. There, you should see your ‘Pull Credit Report’ walkthrough.

- Once the walkthrough is open, you’ll see a Smart Checklist with all the credit reporting products available to you. Select the ones you want to use and click the ‘Next’ button to complete the walkthrough. From there, the Automation Engine takes over, applying portfolios to the account and triggering the integration with our credit partners.

- Within just a few seconds, the credit partner will communicate their data back to Center LMS, updating the customer’s credit score with the results. It will also log a note on the customer, and save information from the report to the customer.

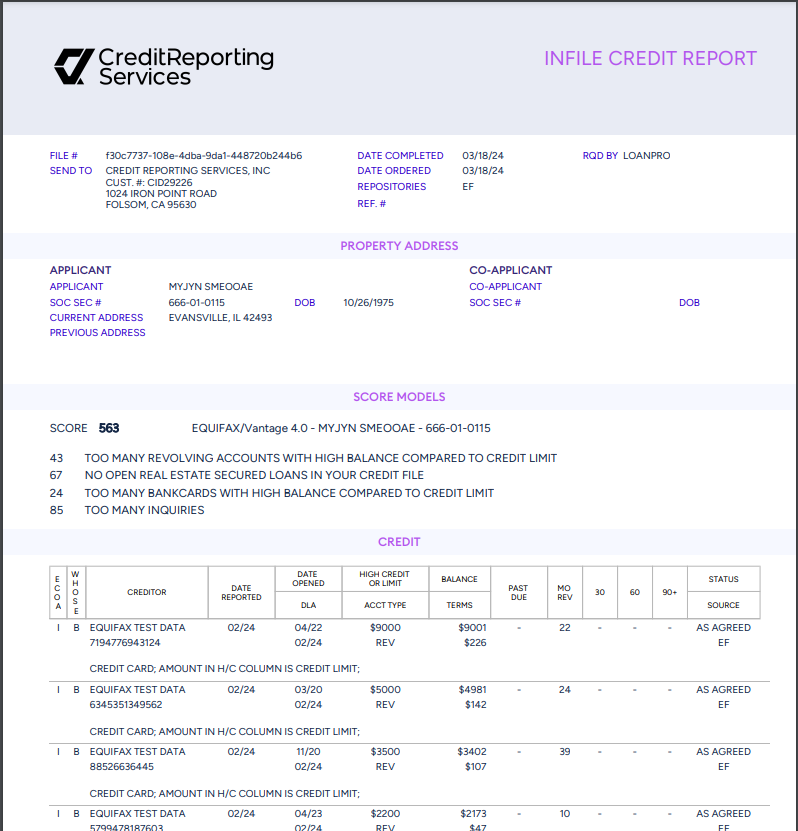

The credit file will look something like these examples:

CRS

If you're using CRS, they'll upload a PDF copy of the report to your customer docs.

Bloom Credit

If you're using Bloom Credit, a note will be added to the Customer Notes of the borrower. It's a detailed document, looking something like this: