Calculating discounts

How discount can be calculated in LMS.

Complexity:

Audience: Loan Servicer or Collector, Upper Management, Loan Servicing/Collections Managers, Accounting

Introduction

A discount (also known as a lender's fee) is a fee typically charged to a dealership to accept a loan, or the difference between the amount paid for a loan note and the face value of the note. For example, a lender may underwrite a $10,000 loan at a $1,000 discount. In this case, the lender would only remit $9,000 to the dealership who referred the borrower to them. The discount portion is, by definition, still part of the original loan principal, but it is a revenue to the lender. However, the revenue is unearned until the principal is paid back by the borrower.

If discounts are a part of your lending business, LoanPro has you covered. LoanPro's discount calculation option lets you select from five different methods of calculating the discount portion of loan payments. In this article, we'll cover how each method works.

Calculation types

To illustrate the differences in the discount calculations, we will use a 24-month loan for $10,000 with a $1,000 discount.

Full

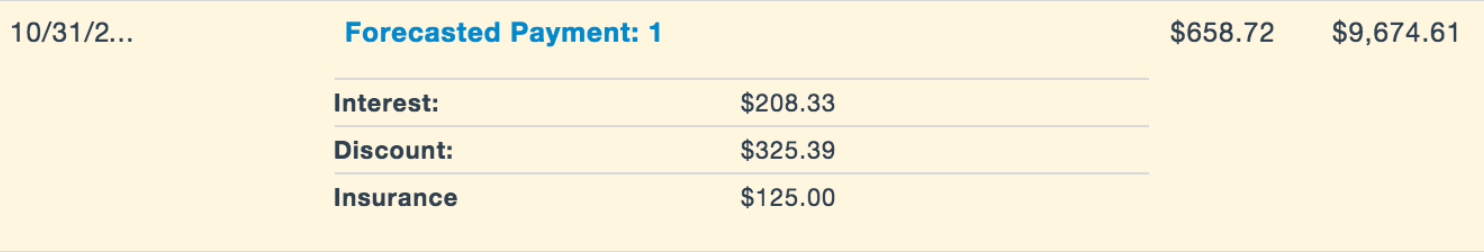

The Full option replaces the principal portion of a payment with the discount. By choosing this option, the borrower will be paying back the discount in place of the principal until the discount amount has been paid in full. Once the full discount amount has been paid ($1,000 in this example), the borrower will begin paying the principal on their remaining payments.

As you can see, the breakdown of the first forecasted payment on our sample loan shows no 'Principal' portion, but it does show a large discount portion.

Percentage

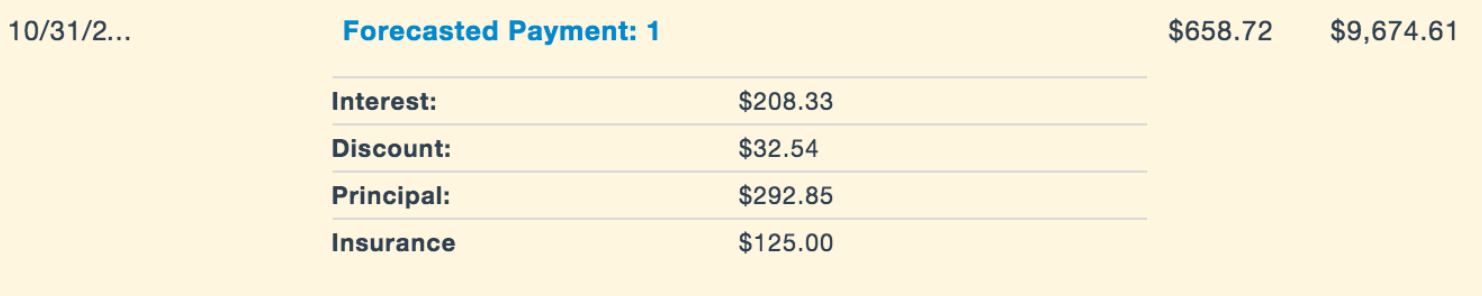

The Percentage method uses a percentage calculation to determine how much discount will be paid off in each payment. The discount amount is calculated by determining the ratio between the total discount amount and the total loan amount. In our example, $1,000 of discount is 10% of our $10,000 original loan balance.

$$\frac {1,000}{10,000} = 0.1 $$

We can then compute the exact discount portion of a particular payment by multiplying the principal portion by 0.1. Let's do the math:

Our payment amount is $325.39 and our discount percentage is 0.1. If we multiply $325.39 by 0.01 we get $32.54—the discount portion of the current payment.

We can confirm this by adding the principal and discount portions in the current example:

$$ $292.85 + $32.54 = $325.39 $$

One quirk of the Percentage calculation is that discount must be due on a loan before any money from payments will be applied towards it. In the above example, if a payment was made before the first payment actually came due on the loan, none of the payment would apply towards discount. The $32.54 would then come due as discount when the payment came due.

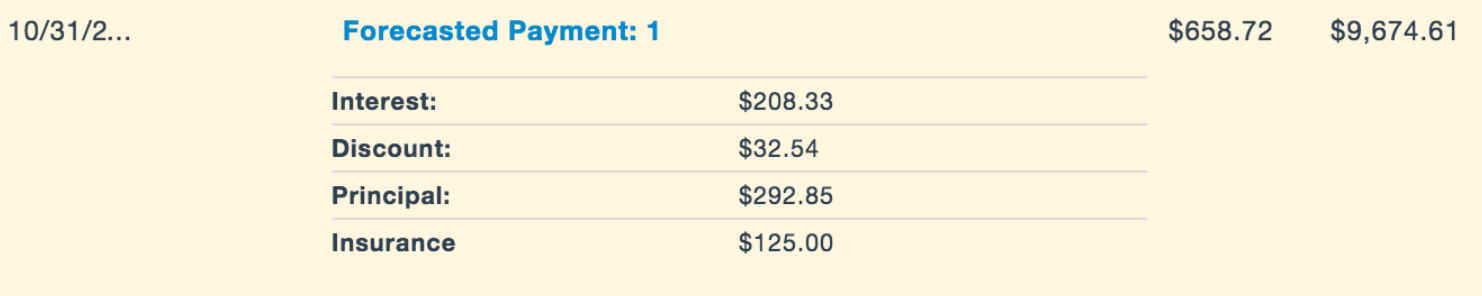

Percentage fixed

The Percentage Fixed calculation works very similarly to Percentage, but there is a slight difference. With the Percentage calculation, a payment made before the first due date will not apply anything towards discount—what would've gone to discount all goes to principal. With Percentage Fixed, however, payments made before the first due date will still put money towards discount.

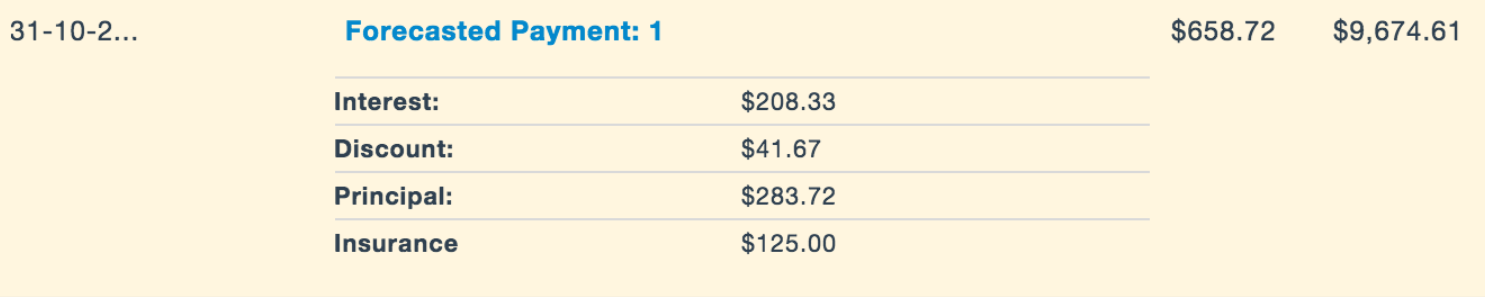

Rebalancing

The Rebalancing option calculates a value as the unpaid discount divided by the remaining term of the loan.

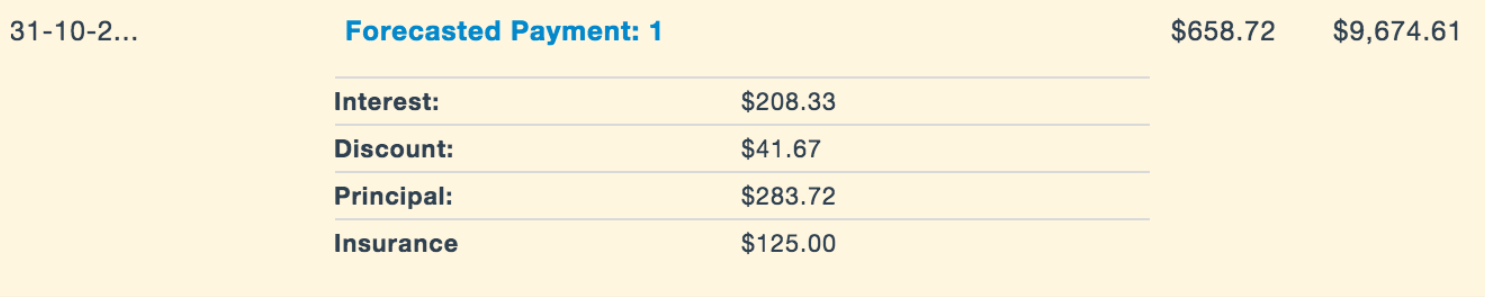

In this case, since this is the first payment on the loan and the payment hasn’t come due yet, the unpaid discount can be calculated as the original discount of $1,000 divided by the 24-month term of the loan:

$$ \frac {1,000} {24} = 41.67 $$

As you can see, the discount per period will be $41.67. This may change for future payments depending on whether the borrower pays on time and pays the full amount. A short first period may affect the discount amount as well.

Straight line

The Straight Line calculation works similarly to Rebalancing; but with a Straight Line calculation, the discount and principal portions are calculated only once for the loan, and they don’t change based on payment schedule or how timely the borrower repays the loan.

You’ll notice that the principal and interest portions of the first payment are exactly the same with the Rebalancing and Straight Line methods. The discount portion of the Straight Line payments won’t change until the final loan payment, and it only does so to ensure that the entirety of the discount amount gets paid and no more.

What's next?

Discount calculations can be configured in the ‘Setup Terms’ of a loan. To learn more about how to setup discounts during the creation of a loan, check out our article creating a loan.

To learn how to apply discounts within LoanPro, preview their impact on loan payments, and analyze their breakdown in detailed reports, read our article on applying and viewing discounts in LoanPro.

Was this article helpful?

Unclassified Public Data