How Nacha files work

The National Automated Clearing House Association (Nacha) manages and governs the Automated Clearing House (ACH) network in the United States. To facilitate ACH transactions, they use Nacha files, which are specially formatted .txt files holding information about each transaction. These files are sent between financial institutions, who then move funds from one account to another.

Secure Payments specifically uses unbalanced Nacha files, which show one-way transactions from your customers.

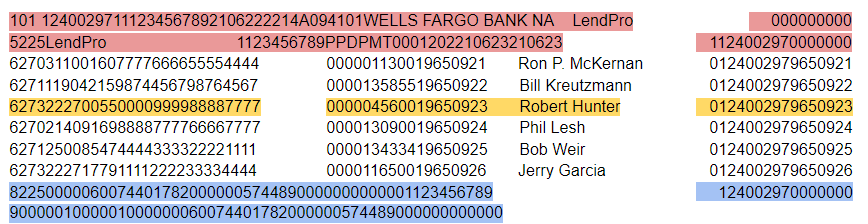

Sample Nacha File

Here's a sample of a Nacha file.

101 12400297111234567892106222214A094101WELLS FARGO BANK NA LendPro 000000000

5225LendPro 1123456789PPDPMT0001202210623210623 1124002970000000

6270311001607777666655554444 000001130019650921 Ron P. McKernan 0124002979650921

6271119042159874456798764567 000013585519650922 Bill Kreutzmann 0124002979650922

6273222700550000999988887777 000004560019650923 Robert Hunter 0124002979650923

6270214091698888777766667777 000013090019650924 Phil Lesh 0124002979650924

6271250085474444333322221111 000013433419650925 Bob Weir 0124002979650925

6273222717791111222233334444 000011650019650926 Jerry Garcia 0124002979650926

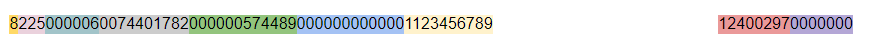

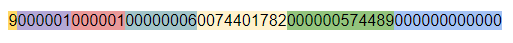

822500000600744017820000005744890000000000001123456789 124002970000000

9000001000001000000060074401782000000574489000000000000At first glance it might seem like just a bunch of numbers, but with a closer look you'll notice the name of your company, the bank you're sending the file to, and each of your customers. Each Nacha file has a two-line header with info about your company, the bank, and the file itself; a list of transactions with customer names; and a footer that totals the transactions and gives some additional info.

In this image, the different parts are highlighted. The two red lines at the top are the header, the yellow line is a single transaction record, and the two blue lines at the end are the footer.

File breakdown

The rest of this article explores what specific parts of the file indicate, but you won't need to manually input any of this information. Secure Payments will automatically create the Nacha file, pulling from your company settings, transactions, and payment profiles.

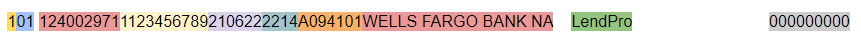

Header, Line 1

Let's break down the first line of the file.

Here's what each part means:

| Field | Example | Description |

| First digit | 1 | A one shows that this row is the first line of the header |

| Priority Code | 01 | A two-digit number showing the processing priority. |

| Routing Number | 124002971 | The routing number for the bank you're sending this Nacha file to. |

| Company ID | 1123456789 | A ten-digit code indicating your company. |

| Date | 210622 | The date the file was batched on, YYMMDD. This date would be June 22, 2021. |

| Timestamp | 2214 | These four digits show the time when the file was batched, shown in 24-hour time. This time would be 10:14pm. |

| File Data | A094101 |

Info about the file itself.

|

| Bank Name | WELLS FARGO BANK NA | The name of the bank you're sending the Nacha file to. |

| Company Name | LENDPRO | The name of your company. (Technically this is just the name of whoever is sending the Nacha file, but the files Secure Payments generates will always have your company here.) |

| Reference Code | 00000000 | This field is optional, and usually used for accounting purposes. |

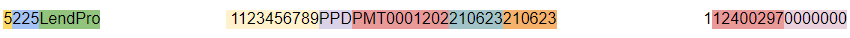

Header, Line 2

Here's what each part means:

| Field | Example | Description |

| First digit | 5 | A five shows that this row is the second line of the header. |

| Service Class Code | 225 | Identifies the type of transactions in the file. 220 means credit only, 225 means debit only, and 200 means a mix. |

| Company Name | LendPro | Your company's name. |

| Company ID | 1123456789 | A ten-digit code indicating your company. Typically, your bank will tell you to use your nine-digit EIN, preceded by a 1. |

| Standard Entry Class Codes (SEC Codes) | PPD | Shows the type of transactions in the file, such as PPD, CCD, CTX, WEB, TEL, etc. |

| Entry Description | PMT0001202 | This data is hard-coded from LoanPro, and will always be PMT0001202. |

| Descriptive Date | 210623 | The date the transactions took place, YYMMDD. |

| Effective Date | 210623 | The date when the transactions will be posted, YYMMDD. |

| Routing Number | 12400297 | The bank's routing number without the Check Digit (the last digit in the routing number). |

| Batch Number | 0000000 | The number of the batch in this file. |

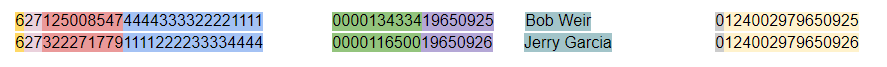

Transaction Records

Here's two transaction records so you can compare and contrast them:

And here's what each part means:

| Field | Example | Description |

| First Digit | 6 | A six indicates that this row is a transaction. |

| Transaction Code | 27 | Indicates the customer's account type. A 27 means you're pulling from a checking account; a 37 means you're pulling from a savings account. |

| Routing Number |

125008547 322271779 |

The routing number for the borrower's bank. The first eight digits help the Federal Reserve and American Banking Association (ABA) identify the bank. The ninth digit is called a Check Digit, and it helps prevent errors. |

| Account Number |

4444333322221111 1111222233334444 |

The customer's account number with the bank. The number of digits can vary. |

| Amount |

0000134334 0000116500 |

The amount of the transaction. The last two digits are cents, with the decimal implied. These two, for instance, are $1,343.34 and $1,165.00 |

| ID Number |

19650925 19650926 |

A number identifying the individual customer. This isn't the customer ID or display ID normally used in LMS or Secure Payments; the system generates this number when it creates a Nacha file. |

| Customer name |

Bob Weir Jerry Garcia |

The customers' names. |

| Addenda Record Indicator | 0 | If there is no addenda (plural for addendum) accompanying this transaction, it will be a “0”. If addenda do accompany the transaction, it'll be a “1”. |

| Trace Number |

124002979650925 124002979650926 |

The system assigns this number so that we can trace the specific transaction if any questions arise. The number is assigned sequentially. |

And that "S"?

Some transaction records will contain an s between the customer name and the addenda record indicator. This is a Payment Type Code, which indicates whether the payment is recurring or single. This field only shows up on WEB or TEL payment records, and in Secure Payments, it'll always be an s for 'single'.

5220Red Star 1123456789TELPMT0001202210914210914 1111000020000030

63211100002523987879 000000033012072589 Alan Vega S 0111000020000034

63211100002582389782 000000028012072590 Martin Rev S 0111000020000035

822000000200222000040000000000000000000006101123456789 111000020000030Footer, Line 1

Here's the first line of the footer:

And here's what each part means:

| Field | Example | Description |

| First Digit | 8 | An eight here indicates that this row is the first line of the footer. |

| Service Class Code | 225 | Identifies the type of transactions in the file. 220 means credit only, 225 means debit only, and 200 means a mix. |

| Entry Addenda count | 000006 | The number of addenda (plural for addendum) for the entire file. |

| Entry Hash | 0074401782 | A sum of all the routing numbers for each transactions. (Note that this is the sum of the first eight digits of each number; it does not include the Check Digit.) |

| Total Debit | 000000574489 | The total of all debit transactions on this Nacha file. The last two digits are cents, with the decimal implied. This number, for instance, is $5,744.89 |

| Total Credit | 000000000000 | Total of all credit transactions in the file; this should be all zeroes. |

| Company ID | 1123456789 | A ten-digit code indicating your company. |

| Routing Number | 12400297 | The bank's routing number |

| Batch Number | 0000000 | The batch number for this file. |

Footer, Line 2

And here's what each part means:

| Field | Example | Description |

| First Digit | 9 | A 9 shows that this row is the second line of the footer. |

| Batch Count | 000001 | Total number of batches in the file. |

| Block Count | 000001 | Total number of records in the file, divided by 10. |

| Entry/Addenda Count | 00000006 | Total number of entry detail and addenda records on the file. |

| Entry Hash | 0074401782 | Same as the Entry Hash in the first line of the footer—a sum of all the routing numbers for each transactions. (Just the first eight digits; not the Check Digit.) |

| Total Debit | 000000574489 | The total of all debit transactions on this Nacha file. The last two digits are cents, with decimal implied. This number, for instance, is $5,744.89 |

| Total Credit | 000000000000 | The total of all credit transactions on this file. |

And what about all those 9s at the end of the file?

Often, you'll see a Nacha file like this, with several lines of the number nine:

101 12400297111234567892106222057A094101WELLS FARGO BANK NA LendPro 00000000

5225LendPro 1123456789PPDPMT0001202210623210623 1124002970000000

6273220791335545778799693323 000000330019649024 Ron Mael 0124002979649024

6273220791339898656532322121 000001210019649025 Russell Mael 0124002979649025

822500000100124002970000000033000000000000001123456789 124002970000000

9000001000001000000010012400297000000003300000000000000

9999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999

9999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999

9999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999

9999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999999These numbers have no meaning, but are just there as filler. Nacha files are in block 10, meaning that the total number of rows should be divisible by ten. In the earlier example file, for instance, there were two lines of headers, six transaction records, and two footers, ten in total. In that file, there was no need for extra filler lines.

This file, however, only has six real lines (two headers, two transaction records, and two footers). To get in valid block 10 format, the system adds four lines of filler.

Next, learn how to configure Nacha processors, automate file delivery, and manage Nacha transactions efficiently within LoanPro in our article using Nacha files.

Was this article helpful?

Unclassified Public Data